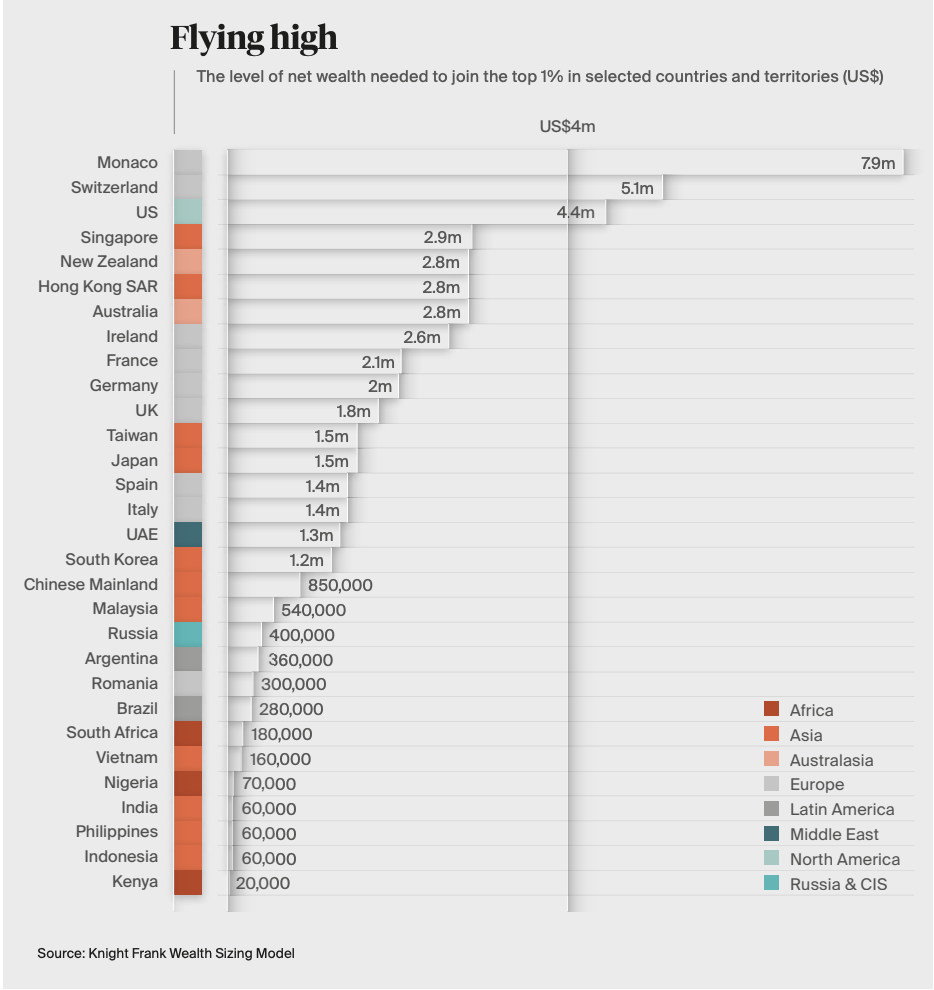

A couple of weeks ago, there was an article in the Business Daily that has costed me many nights of sleep and much consternation. That report has been a major distraction in my mind these past couple of weeks that I almost have been able to really think of little else. The article quoted the Knight Frank Wealth Report 2021, which has it that It takes USD 20,000 / Kshs. 2.2 Million to join the TOP 1% of Kenyans in wealth.

“The top 1% – frequently cited, sometimes maligned, but never really defined. The level of net wealth that marks the threshold for entering this rarefied community varies widely among different countries and territories… Developing economies Indonesia and Kenya have thresholds… at US$60,000 and US$20,000 respectively,” said the report.

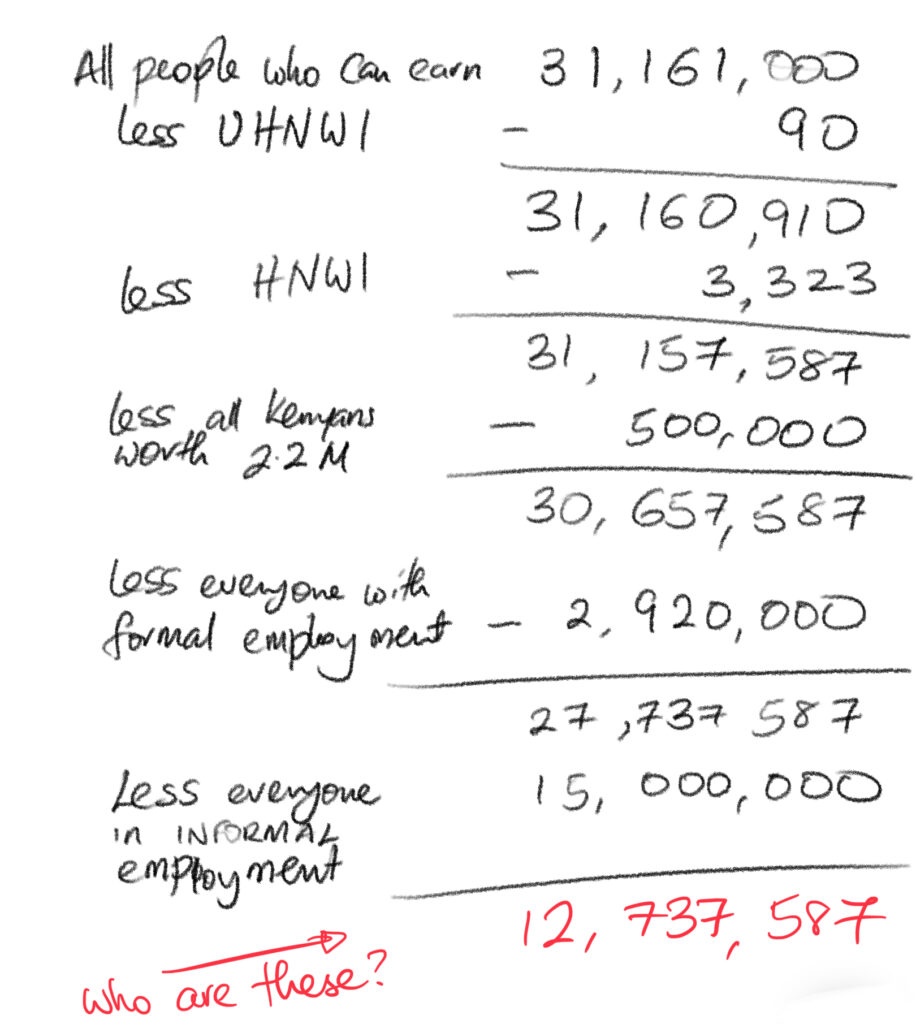

This led me to try and do the math. Kenya’s population aged 15 years and above per my calculation is about 31.1 million. According to the Census of 2019, the population of Kenya was 47 Million and it is widely estimated to have grown to 52 Million. Basic arithmetic then puts that top 1% of Kenyans at 311,000 (if you take the top 1% of people who have the capacity to have income) or between 470,000 Kenyans and 520,000 Kenyans. For the sake of this discussion, let us go with the figure of 500,000 people.

Could we then be saying that only 500,000 Kenyans have a net worth of Kshs. 2.2 Million or US$ 20,000?

Let us look at some data that might help us to corroborate this. There are reportedly 2.92 Million workers in formal employment in Kenya. It is reported that “56 percent of Kenyans working in the public service took home less than Sh30,000 (US$300) compared to 46 percent of their peers in the private sector and 48 percent of county workers.” These average out to 49% of all workers in the formal sector. To make matters even more grave, 1,346, 555 workers earn less than Kshs. 25,000 (US$ 250) according to the same report.

75% of Kenyans earn less than Kshs. 50,000 (US$ 500).

Kenya National Bureau of Statistics

The Kenya National Bureau of Statistics report, released in December 2020, showed that agriculture, fishing, forestry, Information Technology (IT), education, security and transport sectors make the list of industries with the highest number of workers taking home less than Sh10,000 (US$ 100) a month.

By contrast, the Knight Frank Wealth Report shows that there are only 90 Kenyans who qualify for the Ultra-high-net-worth individual (UHNWI) category – people with a net worth of over Kshs. 300,000,000 or US$30 million including their primary residence. The High Net Worth Individual (HNWI) category – people with a net worth of Kshs. 100 Million (US$ 1 Million) – had only 3,323 Kenyans.

Where most Kenyans fall.

If you do rough Arithmetic and take the number of people who could earn a living in Kenya to be 31.1 Million, and simplistically subtract the top 1% and all of these people that we can account for as in the image on the right, you are still left with almost 13 Million people who could earn a living that we cannot account for. Obviously, my math is not remotely statistically accurate, but I don’t think my point is far off.

Generally, there are key features that could be attributed to most of these Kenyans who are left behind. Many of them live outside the cities and in the very rural areas. Many of them a massively under-educated and they blame their circumstances on the devil or (in the case of my coastal people), ghosts or majini. Many of them live on or near high value natural resources – agricultural land, minerals, water bodies – but they do not take full advantage because of ignorance.

By the way: True story

Katana (not his picture here), is a 24 year old man in Malindi, Kenya. He works as a farm hand, where he is paid Kshs. 7,000 per month, which he uses to support his wife and 2 year old child. He looks forward to the day when he will earn Kshs. 20,000 per month and he will then live “maisha ya dhahabu” – a golden life. He does not have an identity card or a tax number because his mother never got a birth certificate. He tried to get it but they gave him the run around and he decided to leave it alone. “God provides, after all,” he says. Katana went to school only up to grade 3 and he left so that he could help his parents fend for the family. He has no savings and does not know where he might even begin. His Mpesa mobile number (mobile banking) is in his uncle’s name. He is entirely unaware of the development initiatives in his area and he has never attended a chief’s baraza, let alone a public participation meeting.

“It is not my place to meddle in such matters – those are things for the rich.”

What does this mean?

- There is a Kenya that does not exist in the view of any of the institutions we have in the country – from banks and Safaricom’s Mpesa to insurance companies and the government. Whereas these people are Kenyans by birth, they are entirely unaffected by the country’s systems.

- Most SME and large businesses are clamouring after (let’s be generous) 5 million customers, ignoring the more than 30 million customers that could be clients. This represents a huge opportunity for Kenya to scale its production and wealth and to increase the number of High Net Worth and Medium Net Worth individuals. Most marketing considers the gainfully employed and most politics is oriented to the top 1%.

- From the Knight Frank Wealth Report 2021, it is obvious that there is a massive gap between the wealthy and the poor, but more importantly, the general level of wealth in Kenya is in fact appallingly low (if that top 1% statistic is to be believed) and should be a major point of concern.

- Questions arise about the metrics that we use for development as Africans – how can we say that our countries are growing at a fast rate, when so many people are unaccounted for? it is clear that the relative wealth created and enjoyed by a few does not translate to wealth or at least relative comfort by the majority of Kenyans. Perhaps the time has come to re-examine how we define “growth” in the context of development and the country.

- Because of their general invisibility, these Kenyans that cannot be quite accounted for economically are horribly exploited by betting companies and fintech loaning companies – many of whom charge a shocking 120% annual interest (see Safaricom’s Fuliza and Mshwari for example).

- The challenge is that majority of the top 1% are on sandy ground considering that most of them are a month away from poverty.

People don’t care

My friend David Sasaki wrote a blogpost in 2012, where he wondered if people could be brought to care about how their taxes were spent. In considering what it would take, he says, “First, raw data is not enough — we need visualizations to understand it. Second, visualizations are not enough — we need journalists to investigate and tell stories about the data. But is telling stories enough?” He pointed to OpenSpending.org, which in those days, was an innovative tool in the UK, that could calculate how much taxes you paid, if you entered your salary. We tried to do the same thing with a tool called Kobole back in 2018 that found that many Kenyans spend about half their salary on PAYE and other sales taxes. The top 1% of Kenyans, paid less in ratio than the lower cadres.

I contend that most Kenyans – even many educated ones – cannot comprehend information about what is done with their taxes – and this opens the way for the political class to wantonly run roughshod over their development needs. Unfortunately, it is fully understandable because three key issues.

First, most Kenyans do not take ownership of their taxes and their role in the scheme of development. As we have been doing our citizen generated data work in various communities in Kenya, it has been interesting observing communities debating the answer to the question “between you and the president, who is the boss?” In most cases, my experience has been that people did not see themselves as owners of the country and the resources managed by their leaders.

Secondly, there exists massive ignorance that is fuelled by under-education coupled with the deep frustration of citizens who do not believe that their opinion matters in matters development. They see their leaders as operating on their own wavelength and it is not uncommon to hear a Kenyan say to another, “when the politicians want something they will get it tupende, tusipende (whether we like it or not).” It is a common belief that citizen issues are likely to be taken somewhat seriously around the time of the elections. Most of these Kenyans did not get quality education – even those who succeeded to finish high school. The Uwezo literacy and numeracy studies have been great barometers of the levels of education of the people.

Third, most Kenyans are simply too busy trying to get by, to take the time to study trends as may be presented in the most simple vizualisations or concentrate on stories relating to pending data. In particular, I think they also give it a miss because hearing about misuse of data leaves them with a negative taste in their mouths. In a study that we conducted in Kenya in 2014, we found that Kenyans find it difficult to care about spending that happens at national or regional level because “I have never seen a Million Shillings, how will I know what a Billion Shillings could do, or whether it has been wasted?” instead, citizens could better relate with spending information if it was in the hyperlocal scale because they could relate to the figures. Only the top 1% may concern themselves with these matters.

So what?

- CSOs Arise! I think that CSOs in Kenya and around the continent have a lot of work to do and that they need to re-invigorate their missions to help citizens understand what the data says, at hyperlocal level, so that they can find relevance in the stories that the data tell and therefore become actively engaged. There is a serious need for infomediaries to be developed at village level who interface with community leaders and help them to appreciate what spending and other data means to them. These hyperlocal infomediaries could be local CSOs whose capacity is developed so that they can consume, digest and disseminate data at village level.

- Citizen Data. As David says in his blog, spending data and visualisations are not enough to galvanise action among citizens because it does not necessarily have context. Citizen Generated Data collected and reviewed by citizens provides them with information around their priorities and needs and this provides a frameowrk through which to evaluate the spending and enables them to better engage government. I now increasingly believe that Citizen Generated Data (CGD) activities should be domiciled with citizen groups and local CSOs and less with government (who should be consumers and facilitators of CGD collection but not producers of CGD). We have recently observed that government officials are subject to political, financial and other red-tape oriented winds that adversely affect Citizen Generated Data projects. This isn’t a complete thought yet and we, at The Open Institute, are still exploring working with counties first.

- A development manifesto is needed in my view that works out new development priorities for African countries that focuses on delivering a new level of development for those people who are entirely left behind through three specific sectors – education (ensure there is a high quality primary and secondary school in every ward), health (make sure there is a health centre in every ward) and the economy (build social infrastructure – not roads and bridges – that make it possible for people to take advantage of their local resources to make a living e.g. make sure there are well qualified agricultural extension officers in every agricultural ward, fisheries officers in fishing communities etc.) What this would mean is a change in policy from one that promotes large scale investment in a few large projects and businesses and instead in promoting the development of hundreds of small and medium enterprises that trade globally. My view is that this would be a significant boost to the wealth of Kenyans within one generation as we shall have more Kenyans having access to opportunities and wealth. There has to be a way to increase the number of the top 1% of Kenyans.

As we talk about the notions of ‘Leave no one behind” there is no doubt, we have work to do.

Also See: Citizen Data vs. Official Statistics

Great article. I’ve noticed a typo:

“According to the Census of 2019, the population of Kenya was 4.7 Million and it is widely estimated to have grown to 52 Million.”

I think this should read 47 million, not 4.7.

Kind regards,

Steve Muchai.

Thanks Steve! The dangers of writing at night. It’s been corrected

So interesting, I’ve always heard of ghost workers, but seeing a huge unaccounted labourforce that few knew of is (no words)…

People generally ignore( not avoid) matters taxes, its constant fluctuation is hard to keep up with, let alone understand. So their is still a knowledge gap to be filled there.

I love this piece 👏👏